POINT OF SALE SYSTEM SOLUTION IN KENYA

A point of sale POS system, or simply POS, is the place where your customer makes a payment for products or services at your store. Simply put, every time a customer makes a purchase, they’re completing a point-of-sale transaction.

Hubtech Limited point of sale software goes beyond credit card processing to help retailers and restaurants incorporate mobile POS features and contactless payment options, eCommerce integration capabilities, and more.

So what does a Hubtech POS system do?

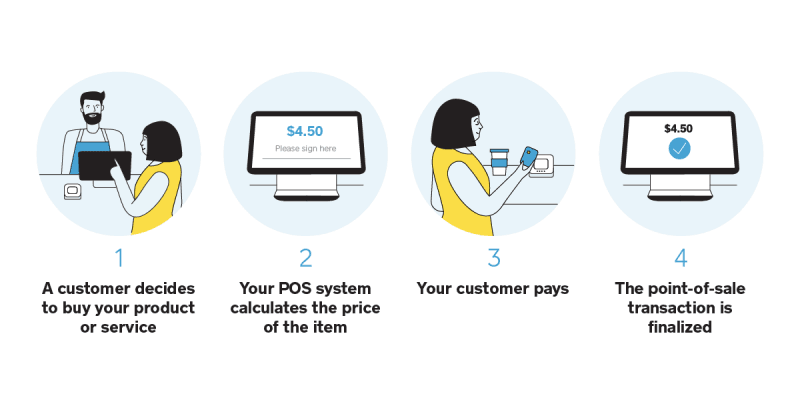

1. A customer decides to buy your product or service. If you have a physical store, they may ask a sales associate to ring them up. That associate could use a bar code scanner to look up the item’s price. Some POS systems, such as the Square Point of Sale, also allow you to scan items visually with the camera on your device. For online stores, this step happens when a customer finishes adding items to their cart and clicks the checkout button.

2. Your POS system calculates the price of the item, including any sales tax. Then the system updates the inventory count to show that the item is sold.

3. Your customer pays. To finish their purchase, your customer will have to use their credit card, tap card, debit card, loyalty points, gift card, or cash to make the payment go through. Depending on the type of payment they choose, your customer’s bank then has to authorize the transaction.

4. The point-of-sale transaction is finalized. This is the moment when you officially make a sale. The payment goes through, a digital or printed receipt is created, and you ship or hand your customer the items they bought.

Understanding what a POS system is—its software and hardware components, as well as capabilities—will enable you to make an educated buying decision.

Common types of POS hardware

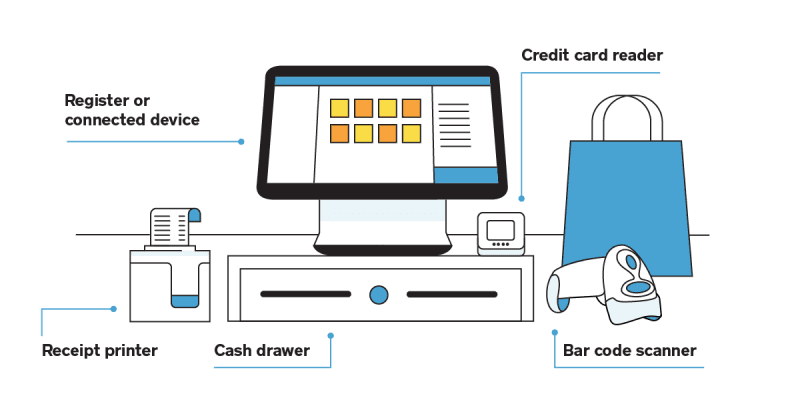

POS hardware allows you to accept payments. If you’re getting a new POS system, you should make sure it accepts all forms of payment, including cash, credit cards (especially chip cards), and mobile payments. If it makes sense for your business, your POS system should also print receipts, store cash in cash drawers, and scan bar codes.

This list of hardware can give you a place to start as you’re evaluating your POS setup options.

Register:

A register helps you calculate and process a customer transaction.

The connected device, such as an iPad or other tablet: A portable device can be a good alternative to a monitor. Tablets can be propped up with a stand, allowing your team to clock in and out.

Credit card reader:

A card reader lets your customers pay securely by credit card while in-store, whether that’s through a contactless payment like Apple Pay, a chip card, or a magnetic stripe (magstripe) card.

Cash drawer:

Even if you accept contactless payments, you may still need a safe spot to keep your cash. POS software that’s connected to a cash drawer can minimize fraud by tracking exactly when the drawer is opened.

Receipt printer:

A paper receipt shows customers exactly what they purchased when they purchased it, and how much they paid.

Bar code scanner:

A bar code scanner reads an item’s product details so you can ring it up. It can also be a quick way to double-check the price, the stock level, and other details.

Common POS software features

Hubtech POS software is like your command center. At a basic level, it allows you to find items in your library and ring up sales. More robust point-of-sale solutions also feature helpful tools such as sales reporting, customer engagement software, inventory management, and more. POS systems also take care of routing funds to your bank account after each sale.

Some POS solutions, such as Square, include the features below. Other systems may require you to use outside software to get the features you need. Learn more about how Square compares to other POS systems.

Payment processing

Payment processing is one of the core functions of a POS system. Each time a customer buys an item, your POS system processes the transaction.

There are several different payment types a POS system might accept:

1. Cash

2. Secure online payments through your eCommerce site

3. Magstripe credit cards, which are cards that you swipe

4. Chip cards, which are credit cards with an embedded chip

5. Contactless payments, which might include a contactless card that customers tap or a mobile wallet (e.g., Google Pay or Apple Pay)

6. Card-not-present transaction, which happens when your customer and their credit card aren’t actually in front of you, so you have to manually enter their credit card information. This also occurs when a customer enters their payment details while checking out online.

Inventory management

Inventory management software allows you to keep tabs on all your products. Some automated inventory software can connect with your sales data and let you know when an item is running low.

POS reports

POS reports give you a quick look into how much you’re selling and earning. With clear reports, you can sell more and make better business decisions.

Employee management

Team management software lets you know when your employees are working and how they’re performing. Your team can also use it to clock in and out, and some types of software can grant permissions so employees can get access to certain tasks.

Customer relationship management (CRM)

A CRM tool that’s tied to POS software lets you see what your customers bought and when they bought it. This knowledge helps you personalize your communications, marketing, and customer service.

Receipts

Receipts make processing refunds easier since there’s a digital or paper trail connected to the purchased item. They can also make your business look more polished.

Tipping support

For restaurants and service professionals, tips can be a big part of getting paid. POS solutions that allow customers to add a digital tip during the checkout process, make it more likely that they’ll tip.

Hubtech POS solutions address the following areas of functionality:

Transaction and payment processing

Clerks and sales associates can enter items, calculate total purchase costs, process multiple payment sources (card, check, cash, etc.), and print customer receipts. They can also use the system to issue refunds for returned merchandise or void transactions performed in error.

Customer relationship management (CRM)

While most POS systems don’t include full-featured CRM software, they usually have some ability to store basic customer data, such as name, contact information, and purchase history. This data can be used to personalize the shopping experience, build marketing campaigns, and access specific transaction details without a paper receipt.

Inventory

Better inventory management is one of the biggest opportunities for retail establishments to improve their bottom line. American retailers have lost an estimated $224 billion by keeping too much inventory in stock, and $45 billion by not having enough. While standalone inventory management software exists, most POS software can update inventory levels in real-time, at the moment the transaction occurs, so you’ll always have an accurate count. Many retail management solutions also incorporate ordering and demand planning tools to keep the shelves stocked through automatic replenishment.

Reporting and accounting

Managers can use POS systems to regularly generate reports and track financial performance for single stores or across multiple locations. These reports satisfy record-keeping and tax requirements and provide insight for future business planning, hiring decisions, and clerical problem-solving. Many POS systems also integrate with full-featured accounting software suites.

Hardware integration

Although many retailers are now using consumer devices to process transactions, it’s still important that solutions support proprietary hardware used to scan items, print receipts, and accept payments. For retail establishments with smaller inventories or mobile sales operations, this can be as basic as a card reader + receipt printer + tablet setup. Larger stores may require more specialized hardware, such as barcode scanners, scales, tag deactivators, and inventory PDAs.

Important factors to consider when choosing a POS system

· Initial setup cost (time and money)

· Payment processing costs (e.g., % of sale + charge per transaction)

· Other monthly processing fees (e.g., PCI-compliance fee, chargeback fees) Equipment costs/rental fees

· POS software fees

· PCI compliance (i.e., how you process payments, connect your systems, and manage customers’ data securely)

· Level of mobility

· Ability to accept EMV chip cards

· Ability to accept NFC payments like Apple Pay, Android Pay, and contactless cards

· POS software features

(e.g., invoices, ability to store customer data safely, inventory management, customer loyalty programs, appointment management)

· How different POS systems compare, like Square vs. Shopify

Benefits of installing Hubtech Limited Point of Sale (POS) Systems

1. Allow inventory tracking across multiple outlets

Firstly, an integrated POS system lets retailers track their inventory across multiple stores in different locations. They can see the stock availability in each of their stores.

2. Improve customer experience

Through POS systems, retailers can provide a better customer experience. Therefore, shop clerks can find products that their customers want in just a few seconds. The systems even allow retailers to create self-service kiosks for their customers, so they can search for items they want themselves.

3. Cloud POS Systems allow retailers to take their businesses anywhere

Imagine taking your business wherever you go. That is not impossible. Cloud-based POS systems allow you to access your sales from anywhere through any mobile device. Therefore, you don’t have to come to your stores to monitor ongoing transactions, track inventory, or view sales data.

4. Ensure the security of customer data.

Customer credit card information must company handled securely. Cloud POS systems ensure all customer data is stored properly and securely. All the data is saved in the Cloud, not in computer systems. Thus, Cloud POS systems eliminate the risk of data loss due to any viruses or damaged systems.

5. Provide complete & precise sales reports

By implementing a POS system, you can generate complete and accurate sales reports. The reports generated include; the number of products sold, bestselling products, profit margins, and many more. Through the system, you can minimize human errors that usually occur when entering sales data, so the resulting data is completely accurate.

6. Speed up product return processes

Lastly, advanced POS systems enable quick product return processes. When a customer cancels a purchase, you can process it through your POS system with just a few clicks. The number of stock that was reduced automatically increases again once the purchase has been canceled.

Trends in point-of-sale software

1. Mobility

Innovations in mobile technology have a profound impact on POS from both sides of the counter. The emerging popularity of mobile wallets will require stores to consider contactless payment terminals that work with QR codes or “near field communications” (NFC) and POS software optimized for contactless payment. Conversely, many retail businesses are adopting their mobile practices to permit movement about the store, reduce countertop footprints, and sell items outside of the store (at conferences, bazaars, service calls, etc.).

2. CRM + POS

Point of sale software with integrated CRM gives businesses the ability to personalize interactions and gather valuable data that can be used for market research. This kind of targeted, data-driven approach can be a strong competitive advantage for stores that use it. Instead of passive transaction processing, sales associates can use CRM insights to make upsell and cross-sell suggestions tailored to each customer. CRM data can also be used to grow repeat customers through drip marketing campaigns and personalized promotions.

3. Security measures

Recent high-profile breaches at stores such as Target, Home Depot, and Michael’s have drawn attention to the inherent vulnerabilities of payment processing. As POS technology continues to evolve, businesses are demanding better security measures. Compliance with PCI DSS (Payment Card Industry Data Security Standard businesses-level encryption, password-restricted access, and tokenized credit card processing are a few of the latest standards.

4. Digital rewards programs

Many businesses are now leveraging their POS systems to run digital rewards and loyalty programs. These programs encourage store visits and specific purchases by offering conditional value rewards (e.g. receive a $10 gift card for every $100 you spend), or exclusive perks (e.g. free shipping for all online orders). Instead of using paper punch cards or complicated mail-in registrations, businesses can use customer loyalty software to provide incentives through digital mediums like mobile, e-commerce, and social media.

5. Creating Executive Buy-In

To ensure successful adoption and long-term ROI, it’s important to “sell” a POS solution to its future stakeholders in the company, especially leadership. They should agree with the need for a POS solution and understand the value it will add. Here are some selling points for specific executives:

6. CIO/CTO

Your chief information officer (or chief technology officer) is responsible for planning and directing IT initiatives that support larger business goals, which is why they’re the first stakeholder you should talk to. It’s also likely that your CIO reports to the CEO and CFO, so it’ll help to have them on your side before moving forward.

7. CEO

Your chief executive officer is tasked with maximizing the value of the company, beating competitors, and optimizing the core business model. No two CEOs are the same: some are eager to embrace new technology for competitive advantage; others focus on big picture plays and consider software a “necessary evil.” Either way, they’ll want to know how a given POS system can improve the company’s position in the market. In many ways, POS is the nucleus of retail operations. It has a direct, measurable impact on customer service, sales, accounting, and inventory management. If your business is using an outdated, inefficient system, performance will suffer in these areas, which hurts your bottom line.

Modern POS solutions — especially cloud-based products — help create a more accurate, real-time infrastructure for retail and extend the same synchronization to ubiquitous mobile access. More than 50 percent of all retailers have already embraced cloud computing to centralize and streamline operations.

8. CFO

As you might have guessed, your CFO will primarily be concerned with the financial impact of a new POS solution. How much will it cost? What will operating expenses look like? Can it bring in additional revenue? How long will it take to recoup the initial investment? To provide accurate answers to these questions, you’ll have to “do your homework.” Calculate the estimated cost based on the number of users and terminals and any charges associated with implementation, then show the cost sheet to your CFO. Since they’re priced on a monthly subscription basis and hosted in the cloud, software-as-a-service (SaaS) products eliminate hefty upfront licensing fees and reduce IT maintenance costs.

Some of the greatest financial benefits aren’t evident in the daily churn of transactions but the connections between POS and other strategic business processes, such as marketing. A POS system with built-in CRM capabilities can support targeted campaigns and loyalty programs that bring keep customers coming back to the store.